is irm stock dividend safe

Years of Dividend Increase. The stock has a current dividend yield of 5 which is highly attractive for income investors.

Irm Iron Mountain Inc New Dividend History Dividend Channel

Iron Mountains Dividend Safety Score of 65 indicating that the REITs dividend is safe and dependable.

. Dividend Safety Rating. Lets take a quick dive into the financials. This indicates a very reliable dividend payer in the past.

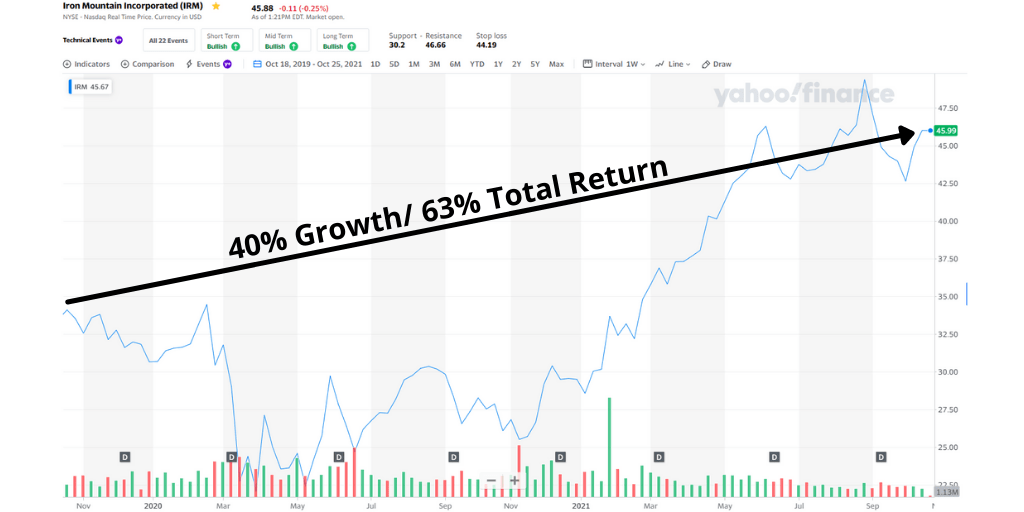

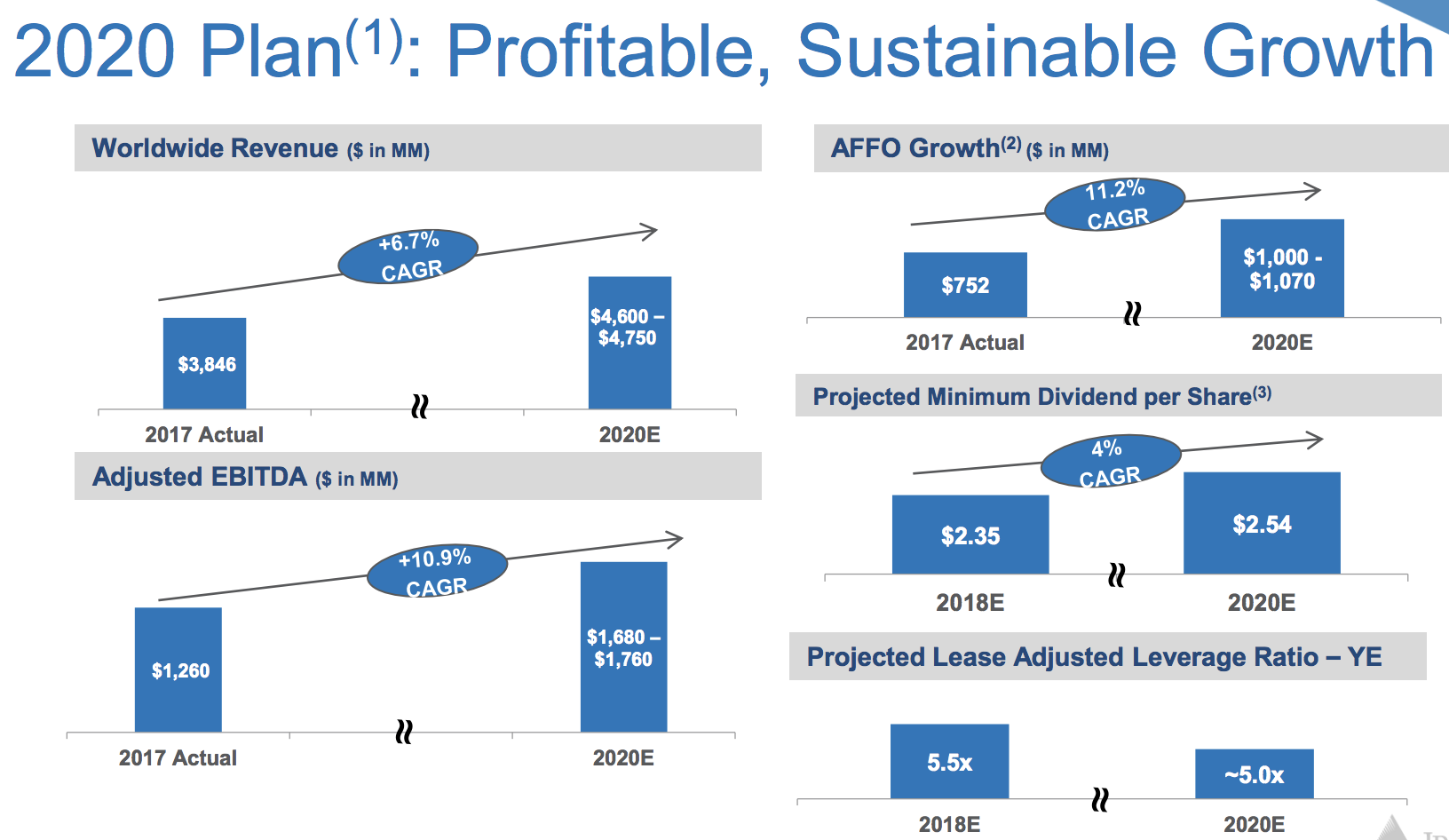

But Iron Mountain has managed to grow its share price and its dividends over the years. Based on the current distribution Iron Mountain stock will pay out around 7500 million to unitholders over the same period. The dividend is paid every three months and the next ex-dividend date is Sep 14 2022.

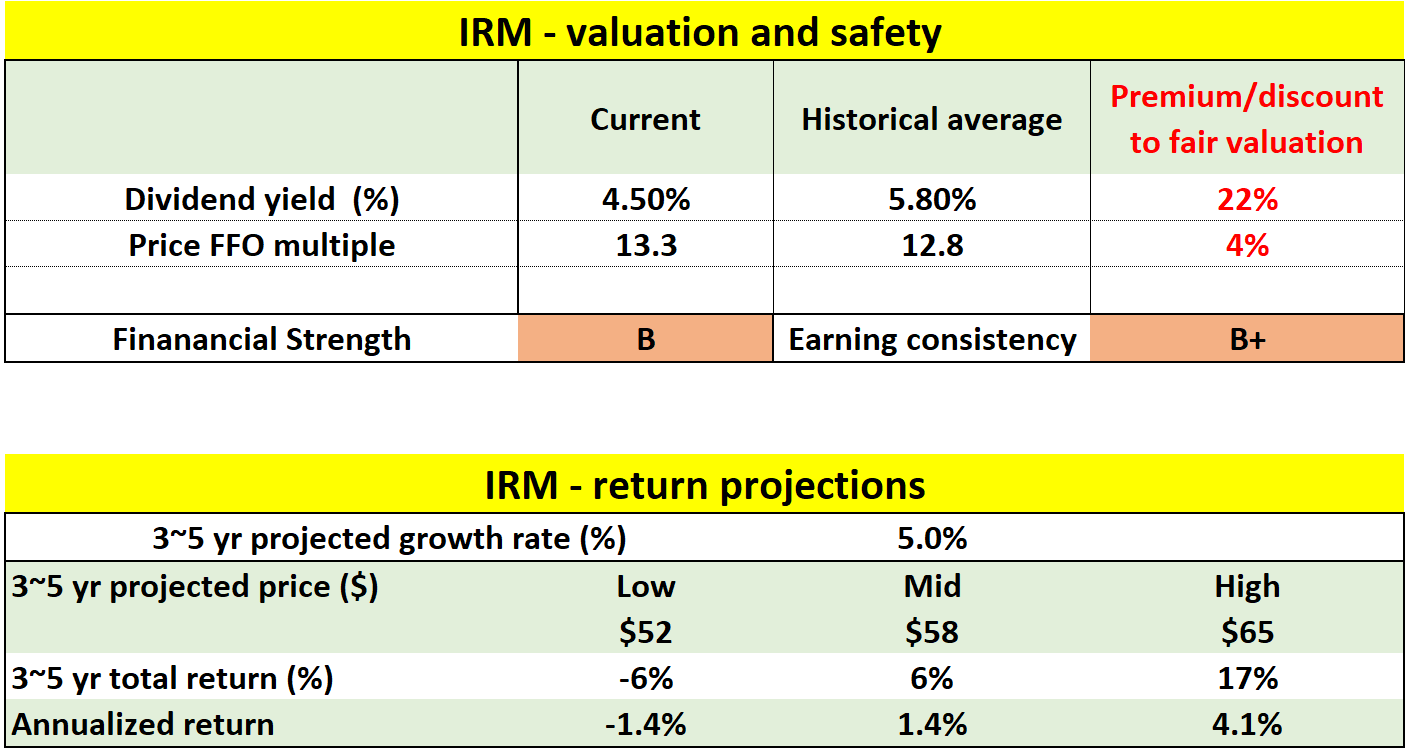

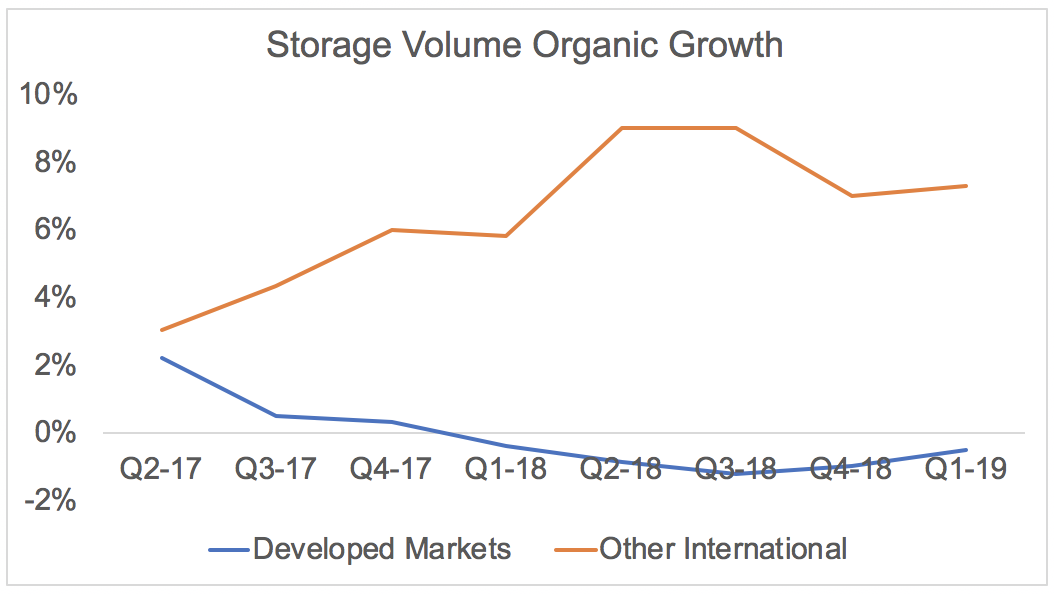

But not all high-yield dividend stocks are safe. Iron Mountain Simply Safe Dividends Although acquisitions still provide somewhat of a growth runway in developed markets there is a limit to how much expansion can ultimately be achieved from this profitable core business especially as more companies move to paperless ie. Their dividend yield has come down slightly edging closer to 590 in recent weeks.

It paid a flat dividend rate of 0618 for the past nine quarters a change from its past decade of steady annual yield rate increases. None of these stocks will entice investors to get up at the crack of dawn like hot growth names can. Payout Ratio FWD 13022.

The latest figures indicate that PM has a dividend yield of 471 a bit lower than earlier in the year but still a safe bet in the current market conditions. For the latest dividend trends and insights sign up for the Wealthy Retirement e-letter below. Therefore you may want to keep a close eye on this dividend throughout the remainder of the year.

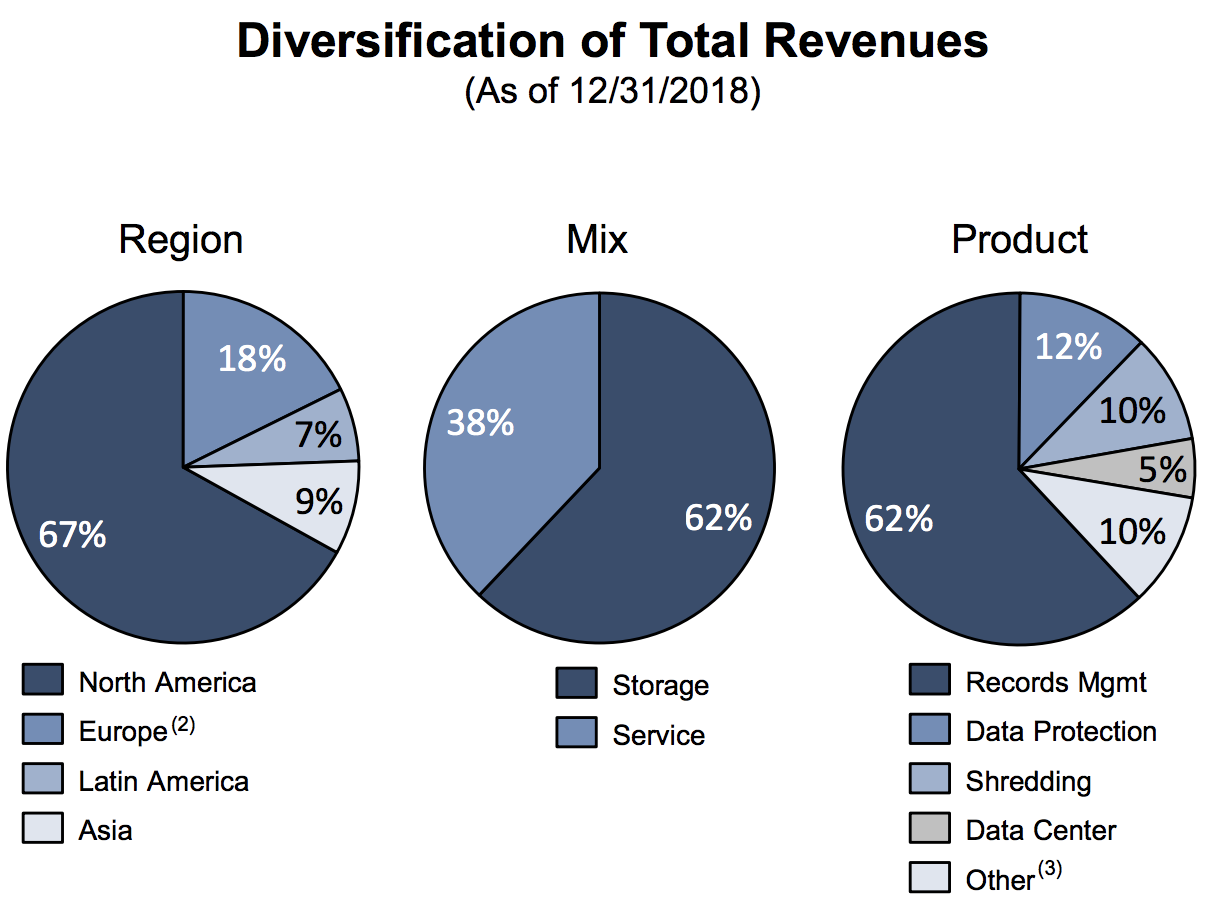

When reviewing Iron Mountains dividend profile keep in mind that the. IRM is a real estate investment trust REIT that provides document storage services. In fact this score is one of the better ones across the REIT sector.

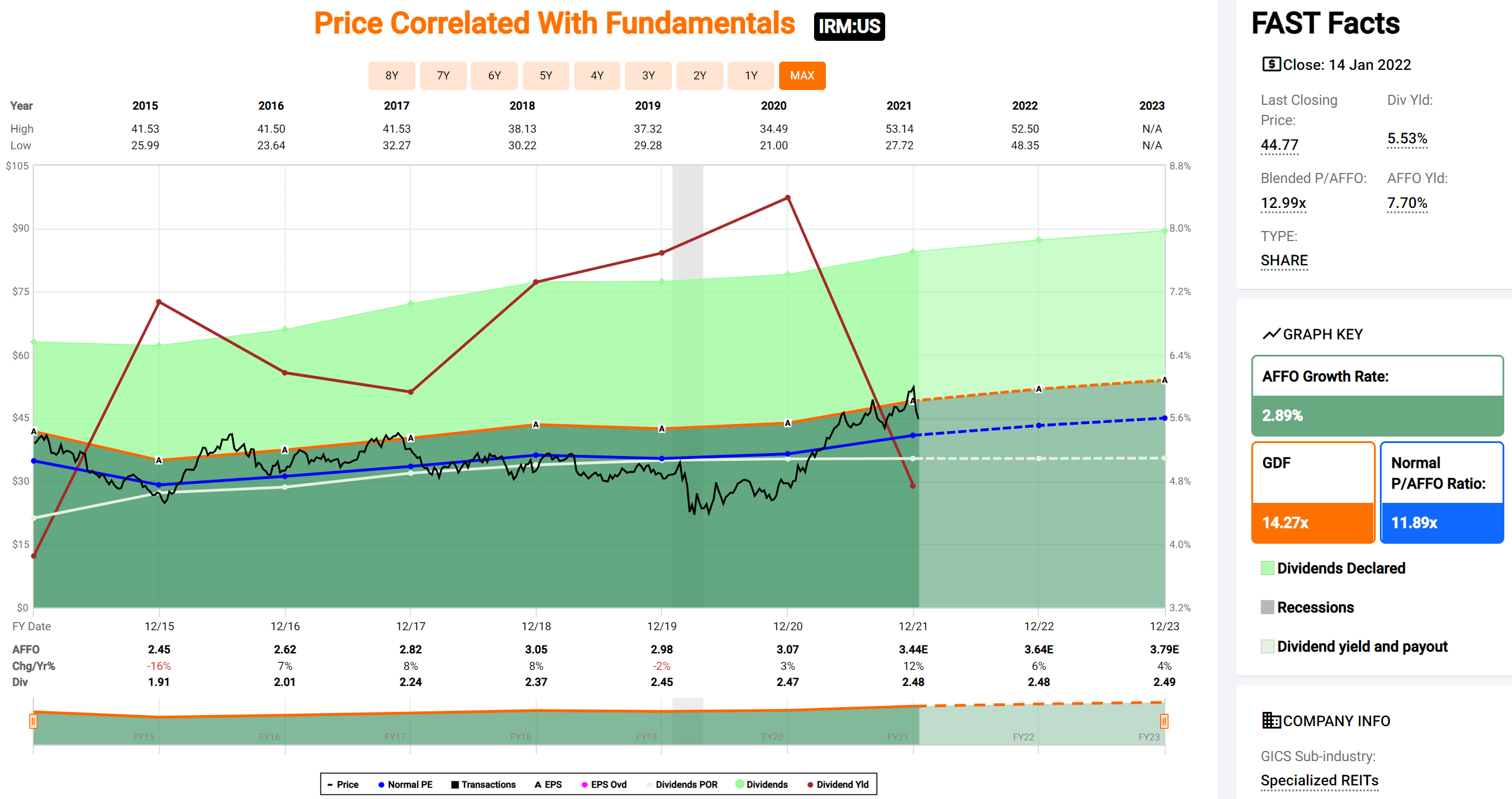

Best dividend capture stocks in Aug. For 2020 management projects the adjusted fund flows from operations to come in between 9300 and 9600 million. With a dividend yield of 53 stock sales are a little expensive.

A safe dividend. Based on earnings Iron Mountain distributes 883 to its shareholders Our metric indicating of the reliability of the dividend is 095 out of max. The company has increased its annual payouts every.

Iron Mountains dividend yield is a meaty 73 near all-time highs for that crucial metric. More often than not youll hear that IRM stock is overvalued and that the company cant afford to maintain its frothy dividends. Ive researched and written about this stock for my Dividend Hunter Insiders.

The average REIT using Vanguard Real Estate Index ETF as. High dividend stocks appeal to many investors in retirement because they provide generous passive income especially in todays low interest rate world. What type of REIT is IRM.

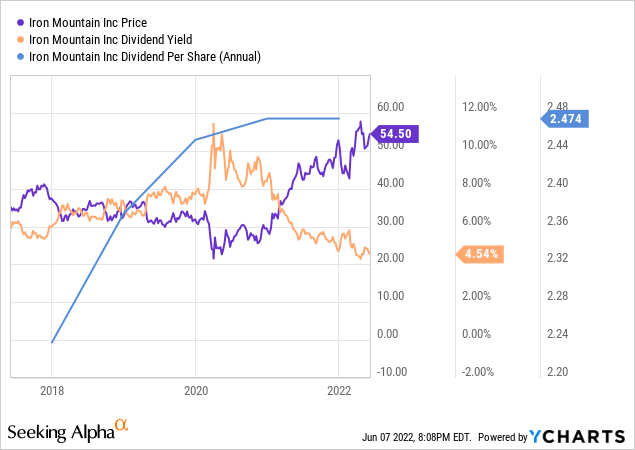

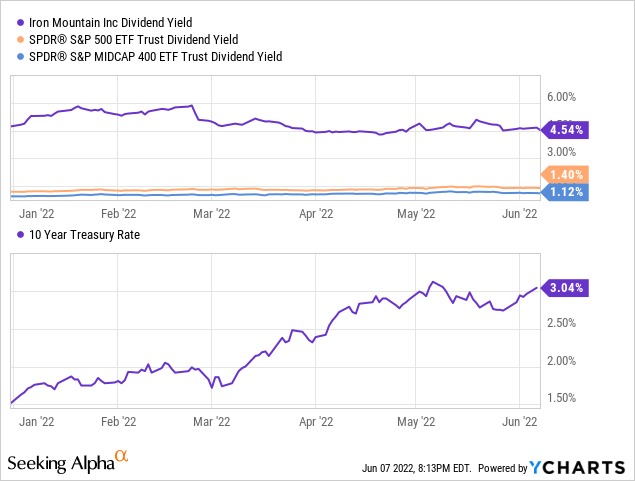

To gauge the sustainability of a companys dividend one metric that investors should take a look at is the companys free cash flow per share on. IRM has a dividend yield of 454 and paid 247 per share in the past year. Iron Mountain Inc NYSEIRM is a bullish high-yield dividend stock that never seems to catch a break from analysts.

All of which leaves IRM stocks dividend on solid ground. At the start of 2022 NHI had a dividend yield of 634 the highest among blue-chip offerings. Stock prices have also increased by 991 over the last six-month period with a 52-week average of 5022 low and 6923 high.

Find the best quality stocks from around the world for your investments in our screener. With its 92 yield and 10 straight years of dividend increases it gets a lot of attention from income investors and generates quite a few emails from my readers. Many of the highest-paying dividend stocks offer yields in excess of 4 and some even yield 10 or more.

Is IRM stock dividend safe. Nevertheless when investors dont. Cumulative distributions including dividends and share buybacks grew at a 21 annual rate since 2013.

Iron Mountain IRM had been an attractive dividend stock but as IRM share price doubled from the pandemic crash the yield has become less appetizing. Besides the United States Philip Morris holds substantial influence over the tobacco industry especially in Europe and African markets. Can income investors trust Iron Mountain Incs NYSEIRM 92 dividend yield.

The means debt and stock sales are key issues for investors to monitor. Iron Mountain Inc. Iron Mountain IRM Dividend Data.

As you can see the Iron Mountain dividend safety is at a high risk of being cut.

Ex Dividend Reminder Westrock Black Stone Minerals And Exxon Mobil Nasdaq

How Safe Are Iron Mountain And Its Dividend The Motley Fool

Iron Mountain Stock Offers An Iron Dividend Nyse Irm Seeking Alpha

Iron Mountain Stock Offers An Iron Dividend Nyse Irm Seeking Alpha

Iron Mountain Stock Downgrade To Hold After 33 Gain Nyse Irm Seeking Alpha

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

Iron Mountain A Strong Performing Reit Nyse Irm Seeking Alpha

Iron Mountain Stock Why This Cash Cow Is Now A Buy Nyse Irm Seeking Alpha

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

Ex Dividend Reminder Atlantica Sustainable Infrastructure Riocan Reit And Credit Agricole Nasdaq

Rsi Alert Us Bancorp Now Oversold Nasdaq

Iron Mountain Incorporated Nyse Irm Declares 0 62 Quarterly Dividend Marketbeat

Pin On Dividend Income Glory Investing Show

Iron Mountain Inc 8 4 Yielding Stock Could Run Higher In 2021

Ex Dividend Reminder Telephone Data Systems Maxar Technologies And Iron Mountain Nasdaq

Iron Mountain Dividend Safety Will This 9 25 Yield Fall Off A Cliff

Iron Mountain Stock Offers An Iron Dividend Nyse Irm Seeking Alpha

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends